Reading time:

10 Best Affordable POS Systems for Small Businesses in the UK (2025)

Discover 10 affordable POS systems for UK small businesses. Compare prices, features & hardware-free options for cafés, shops, food trucks & more.

You know what a POS system is.

You just want one that works, doesn’t cost a fortune, and actually suits a small business in the UK.

So, in this guide, I’ve listed 10 affordable POS systems made for small UK businesses, whether you’re running a food truck, yoga studio, or high-street shop.

Simple pricing. Real use cases.

And yes, a few that don’t need any hardware.

Let’s get you caught up.

Who This List Is For

This list is for any UK seller who wants a simple, low-cost way to take payments, without bulky hardware or long contracts.

It’s perfect for:

Local shops, cafés, and salons

Food trucks, pop-ups, and markets

Freelancers and mobile service pros

Event sellers and solo founders

Anyone selling online, in person, or both

If you run a business and want to save money on payments, this list is for you.

How We Picked These Tools

We chose POS systems that are:

UK-based — Priced in GBP and built for local businesses

Truly affordable — We looked at all costs: monthly fees, transaction rates, hardware

Easy to set up — No tech skills or complicated setup needed

Reliable support — Good help when you need it

Hardware-free (when possible) — Tools that work right from your phone get extra points

Simple, low-cost, and made for real UK sellers.

Here’s a quick comparison between the 10 POSs to find the perfect solution for you.

10 Best Affordable POS Systems for Small Businesses in 2025 (with a Quick Comparison Table)

Tool | Starting Price | Hardware Needed | Ideal For | Transaction Fee | Free Plan? |

Tapp | £0/month | No | Sellers who want a phone-based, hardware-free setup | 1.49% flat | Yes |

Zettle | £29 one-time | Yes | Retail shops, cafés | 1.75% | Yes |

SumUp | £39 one-time | Yes | Small retailers, market sellers | 1.69% | Yes |

Square UK | £0/month | Yes (optional) | Cafés, in-person and online sellers | 1.75% | Yes |

Dojo | £20+/month | Yes | Restaurants, pubs, hospitality | Custom | No |

Shopwave | Custom quote | Yes | Quick-service chains | Custom | No |

Lightspeed | £69/month | Yes | Larger retail stores | 1.5–2.6% | No |

Shift4 (SkyTab) | Custom quote | Yes | Hospitality and restaurant chains | Custom | No |

Clover UK | £39+/month | Yes | Multi-location shops | 1.69–1.99% | No |

Epos Now | £25+/month | Yes | Hospitality and retail | Custom | Free trial |

Let’s get into the details.

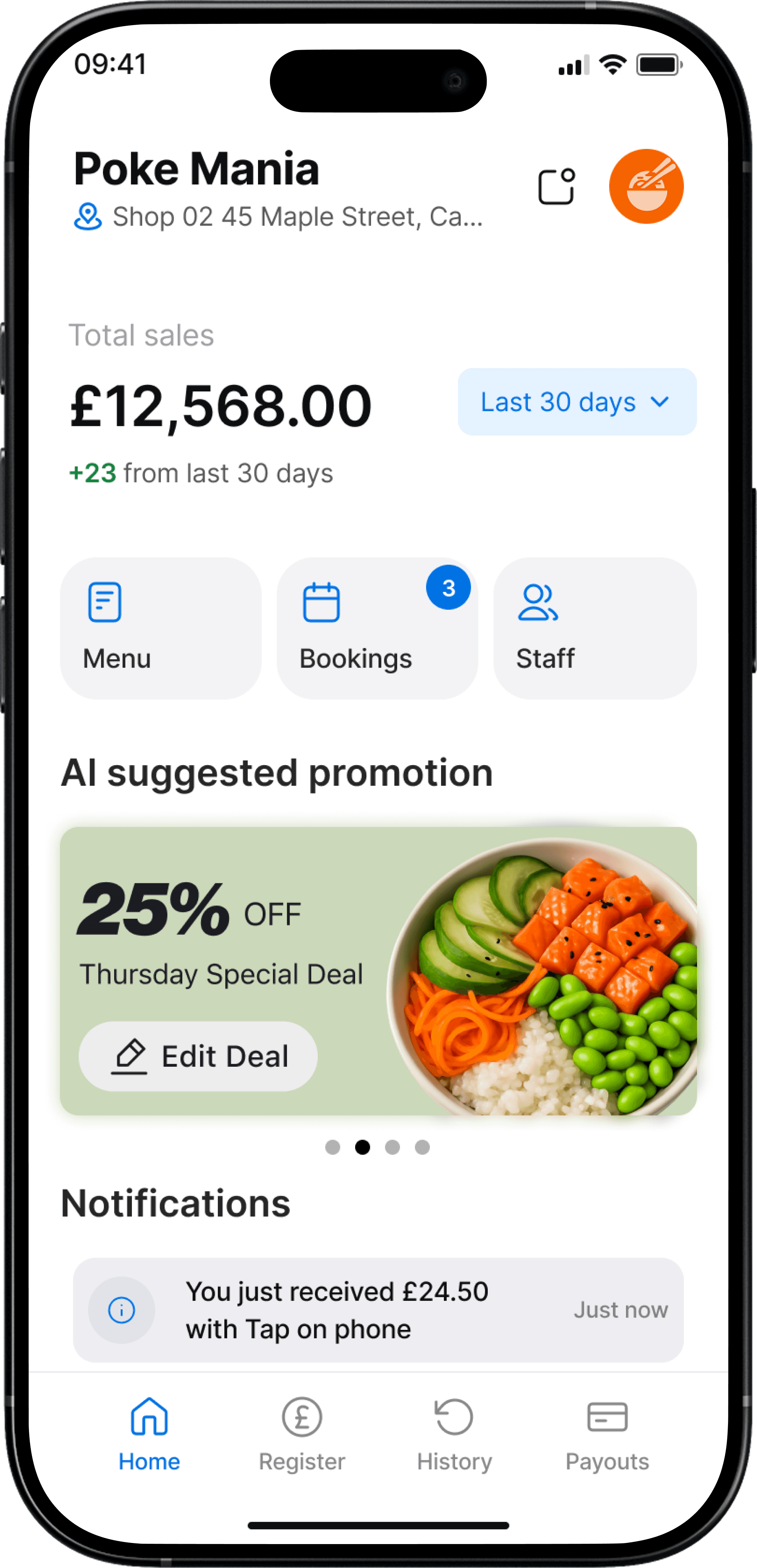

Usetapp.io: Best Terminal-Free POS for UK Mobile Businesses

What is Tapp?

Tapp is an AI-powered, terminal-free payment and online ordering platform designed for small and medium-sized businesses.

It turns any smartphone into a POS with no hardware, no setup fees, just tap-and-pay.

Who It's For

Market traders

Food trucks

Pop-ups

Beauty & wellness professionals

Cafes, bistros, and small restaurants

Service providers who value mobility, speed, and ease of use

Core Value Proposition

“No terminals. Just Tapp.”

Launch in minutes with AI-powered onboarding

Accept contactless payments via smartphone

Self-serve checkout via QR codes or an online shop

Real-time payment notifications

Digital receipts via SMS/email

Built-in PCI compliance and secure transactions

Pricing Snapshot

Plan | Cost | Key Features |

Free | £0/month | Unlimited transactions, 2% flat fee, business dashboard |

Pro | £29/month | Everything in Free + Live support, AI sales prediction, 2% flat fee |

What Makes Tapp Different?

AI-powered digital setup: menus, KYC, onboarding

No contracts or hardware dependency

Works as both a POS + an eShop with QR & online checkout

Transparent pricing with no setup or monthly fees (on Free plan)

Zettle by PayPal: Best for Simple Hardware-Based Setup

What is Zettle?

Zettle by PayPal (now part of the PayPal Point of Sale ecosystem) is a hardware-based POS and payment system designed for small and medium-sized businesses.

It combines in-store payment terminals, mobile card readers, and a versatile POS app to help merchants manage payments, inventory, staff, and reporting in one place.

Zettle turns your phone or tablet into a smart POS, or works with advanced hardware like the PayPal Terminal.

Who It’s For

SMBs that already use or trust PayPal

Businesses looking for integrated POS + payments + reporting

Core Value Proposition

“Sell smarter with PayPal’s all-in-one POS system.”

Accept contactless, chip & PIN, and mobile wallet payments

Fast payouts to a PayPal Business account within minutes

No monthly fee or rental cost — just buy hardware and start

Sell in-store, online, or remotely via invoicing and payment links

Track inventory, sales, staff, and performance in real time

Works with smartphones, tablets, and optional hardware (readers, tills, printers)

Zettle Pricing Snapshot

Plan | Cost | Key Features |

POS App | £0/month | Free POS app, unlimited products, reporting dashboard |

Card Reader | £29 (one-time) | Connects via Bluetooth, 1.75% per transaction |

Terminal | £149 (one-time) | All-in-one touchscreen POS with 4G/WiFi + receipt printer, 1.75% fee |

Custom Pricing | Custom (for high volume) | Tailored rates for businesses processing £10,000+/month |

Pros and Cons of Zettle

Here’s a simple table showing what people liked and didn’t like about Zettle in their recent reviews:

Pros | Cons |

Easy to use when the terminal works | Devices often fail just after warranty; no repair options |

Smooth account setup for some users | Poor customer support when issues arise |

Some loyal users satisfied after years of use | Long account verification process delays onboarding |

Acceptable transaction rates for basic use | High transaction fees; AMEX cannot be disabled |

Helpful staff during initial onboarding | Reports of fraud and money going to wrong accounts |

No refund or resolution if terminal fails after warranty | |

Quality and service have declined since PayPal acquisition | |

Multiple devices suddenly stop working | |

No resolution follow-up from support, even after repeated contact |

What Makes Zettle Different?

Trusted PayPal ecosystem for instant access to funds

Multiple checkout methods: POS, QR, PayPal, contactless, e-commerce

Fast onboarding with no rental fees or long-term contracts

Offline mode support to keep selling even with no connection

Complete business toolkit: POS + inventory + analytics + multi-user access

Omnichannel capabilities: accept payments anywhere, anytime

SumUp Air: Best Entry-Level POS for Solo Traders

What is SumUp?

SumUp is a payment solution provider offering affordable card readers and mobile POS tools designed for small businesses.

With no monthly fees on basic plans, SumUp helps you accept card and contactless payments anywhere via simple, low-cost hardware.

Who It’s For

Small shops

Market stalls and mobile vendors

Food trucks and cafés

Freelancers and beauty professionals

Service-based businesses needing card readers

Core Value Proposition

“Get paid anywhere. No contracts. No surprises.”

Affordable card readers starting at £25

Accept all major cards and wallets (Visa, Mastercard, AMEX, Apple Pay, etc.)

Free SumUp mobile app for reports, insights, and item management

Instant setup and easy onboarding

Next-day payouts, even on weekends

No monthly fee on Pay-as-you-go plan

SumUp Air Pricing Snapshot

Plan | Monthly Cost | In-person Fee | Online Fee | Key Features |

Pay-as-you-go | £0 | 1.69% | 2.50% | Free app, no contract, buy device separately |

Payments Plus | £19 | 0.99% | 0.99% | Lower fees, dedicated support, pro tools |

POS Pro | £49 | Custom | Custom | Advanced POS features, contact sales |

Card Reader Pricing

Device | Price | How It Works |

Tap to Pay (Phone only) | £0* | Accepts contactless directly on your smartphone |

Air | £25* | Basic reader, connects via Bluetooth to phone |

Solo | £69* | Built-in SIM, standalone card reader with screen |

Terminal | £139* | Full POS with receipt printer, WiFi + 4G, item mgmt |

*All prices excl. VAT. 30-day money-back guarantee.

SumUp Air Pros and Cons

Here’s a table with the top 5 pros and cons of SumUp Air, based on their recent reviews:

Pros | Cons |

Easy to use for both sellers and customers | Devices get blocked without warning |

Tap-to-pay via mobile phone is fast and convenient | Customer support is slow and hard to reach |

No monthly fees – pay only per transaction | Older devices become unsupported after updates |

Fast payouts with no hidden charges | Bluetooth connection issues with Air device |

Works well for freelancers and small business owners | Payment delays and occasional failed transactions |

What Makes SumUp Different?

No monthly cost on standard plans

Plug-and-play setup (even on your phone)

Fast payouts, even on weekends

Flat and transparent fees (no hidden charges)

Works online, in-person, and via payment links

Built-in SIMs for mobile card readers

Square UK – Best for Multi-Channel Sellers

What is Square?

Square is a full-stack payment, POS, and business management platform designed for growing businesses.

It helps you sell online, in-store, or on-the-go while also managing inventory, staff, marketing, and more from one dashboard.

Who It’s For

Restaurants and cafés

Retail stores

Beauty and wellness professionals

Fitness studios and appointment-based businesses

Multi-location businesses

Online sellers looking to sync with offline sales

Core Value Proposition

“All-in-one commerce tools. Start free, scale fast.”

POS system with built-in payment processing

Online store and checkout tools

Staff and inventory management

CRM with loyalty, invoicing, and email marketing

Banking, payroll, and loans under one roof

Hardware options for every business model (handheld, register, terminal)

Square Pricing Snapshot

Plan | Cost | Key Features |

Free | £0/month | POS app, online store, customer directory, invoicing, basic reporting |

Plus | £29+/mo | Advanced tools for retail, restaurants, or appointments (varies by business) |

Premium | Custom | Bespoke setup, dedicated support, lower processing fees |

Processing Fees (UK Standard):

In-person: 2.6% + 15p

Online: 2.9% + 30p

Manual: 3.5% + 15p

Invoices: 3.3% + 30p

Square Pros and Cons

Here’s a table with the top 5 pros and cons of Square, based on their recent reviews:

Pros | Cons |

Easy and quick to set up | Customer support can be unhelpful or hard to reach |

Fast next-business-day payouts | Device updates happen too often and take too long |

Simple and user-friendly POS system | Delays in account verification, especially for large payments |

Great for mobile/on-the-go use (e.g., taxi, stalls, small shops) | Refunds to end customers can take up to 14 days |

Helpful sales reporting and daily email summaries | Unexpected daily transfer limits after account reviews |

What Makes Square Different?

Omnichannel selling: Syncs online + in-person sales

Hardware ecosystem: From £149 stands to £799 registers

Banking built in: Instant transfers, loans, savings, and debit cards

Free POS software with optional paid upgrades

Tailored pricing by business type: Retail, restaurant, appointments

Integrates loyalty, CRM, marketing, and inventory in one system

Dojo – Best for UK Hospitality Businesses

What is Dojo?

Dojo is a modern payment platform built specifically for fast-paced hospitality, personal services, and in-person businesses.

It offers ultra-fast mobile card machines, seamless EPOS integrations, and real-time insights.

It’s best known for serving cafes, pubs, restaurants, salons, and mobile service professionals who need speed, reliability, and intuitive tools at the point of payment.

Who It’s For

Restaurants, pubs, and cafés

Barbers, salons, beauty professionals

Mobile businesses (e.g. tree surgeons, taxis)

Quick-service counters and food stalls

Dental clinics and healthcare

Any business needing on-the-go payments and EPOS sync

Core Value Proposition

“High-speed, secure, and service-first payments.”

Built to keep your business moving fast and your payments even faster.

Card machines 58% faster than industry average

Dual Wi-Fi + 4G connectivity

10-hour battery life for mobile usage

Seamless EPOS integration (400+ systems)

UK-based 7-day support and remote troubleshooting

Simple PCI compliance and built-in security

Dojo Pricing Snapshot

Plan | Cost | Key Features |

Fix | £39.99/month | Flat pricing for <£100k turnover, includes AMEX, locked for 12 months |

Flex | Custom | Tailored rates, £10/month/location platform fee, flexible contract options |

Pro | Custom | Bespoke deal for £1M+ turnover, lower fees, tailored hardware + setup |

Hardware | From £15/month (or £179 one-time) | Dojo Go, Pocket, or Wired machines with next-day delivery |

Processing + Hardware

Accepts Chip & PIN, contactless, Apple Pay, Google Pay

Tap to Pay on iPhone (no hardware required)

10-hour battery, portable and lightweight

Integrated receipt printer

Works with 400+ EPOS systems

99.99% uptime with auto-connect Wi-Fi/4G

Dojo Pros and Cons

Here’s a table of the Top 5 Pros and Cons of Dojo, based on their recent reviews:

Pros | Cons |

Easy and smooth onboarding process | Aggressive sales tactics and spammy reseller calls |

Intuitive card terminals and simple mobile dashboard | Difficult cancellation experience and contract exit issues |

Helpful, UK-based customer support (often praised by name) | Delays or holds on payouts due to compliance checks |

Reasonable fees compared to competitors (for many users) | Inconsistent support for complex issues or unusual use cases |

PCI compliance made simple with built-in features | Unexpected post-cancellation charges and poor follow-up |

Customer service reviews are the most mixed.

Some users praise the support, while others report slow responses or poor issue resolution.

What Makes Dojo Different?

Built for speed: Card machines 58% faster = serve 48 more customers/day

Always connected: 4G + Wi-Fi = never miss a sale

Hospitality-first design: Split bills, tipping, staff permissions, daily reports

Flexible setup: From full-service restaurants to salons, plug into your flow

iPhone-native payments: No hardware needed with Tap to Pay on iPhone

Exit support: Will cover up to £3,000 in switching fees (terms apply)

Shopwave – POS for Quick Service Restaurants

What is Shopwave?

Shopwave is a modern, omni-channel POS and retail management platform built for fast-growing food and beverage businesses.

It’s designed to simplify complex restaurant and retail operations connecting front-of-house, kitchen, payments, and inventory under one scalable system.

Used by brands like Cook and Timberyard, Shopwave helps QSRs and retail chains manage multiple ordering formats, improve accuracy, and serve customers faster.

Who It’s For

Quick service restaurants (QSR)

Coffee shops & bakeries

Fast casual or multi-location restaurants

Food halls and supermarkets

Retailers with online + offline operations

Brands scaling across multiple stores

Core Value Proposition

“Built for fast service brands ready to scale.”

Shopwave delivers high-speed, flexible commerce infrastructure to simplify workflows and unify customer experiences across all channels.

Mobile-friendly POS and Roaming ordering

95%+ inventory accuracy with built-in stock tools

Kitchen Display System (KDS) to improve prep time

Real-time analytics dashboards

BYOD, kiosk, and mobile ordering support

Integrates with thousands of services and processors

Shopwave Pricing

No transparent pricing, it is not available publicly.

Shopwave Pros and Cons

✅ Pros | ❌ Cons |

Designed for fast-service restaurants and QSR workflows | No transparent pricing available publicly |

Flexible ordering: counter, kiosk, mobile, BYOD | No native customer review/rating feature |

Highly accurate inventory and kitchen management tools | Learning curve for full feature adoption in larger chains |

Omnichannel experience with full POS + Payments + Analytics suite | Smaller user community compared to Square or Toast |

Built-in APIs and integration with 1000s of third-party tools | Limited DIY documentation; relies on demos and onboarding support |

Also NOTE: These pros and cons are based on what Shopwave highlights on their website.

Since there aren't many public user reviews available, it’s a good idea to book a demo and see if it fits your business before making a decision.

What Makes Shopwave Different?

QSR-first design: Optimized for fast-moving restaurants with multiple order and payment formats

Inventory + KDS Integration: Drives operational accuracy and prep time reduction

Experiential Retail: Focus on customer experience across all channels and devices

Enterprise-Ready Stack: APIs, payment orchestration, ELT/iPaaS integration, and BI dashboards

No contract needed for demo: Easy to explore without commitment

Lightspeed UK – Best for Growing Retail Chains

What is Lightspeed?

Lightspeed is a global commerce platform offering unified ePOS + payments designed for retail, restaurants, and golf businesses.

In the UK, it’s best known for helping retail chains and hospitality brands scale operations across multiple locations with advanced reporting, inventory tools, and integrated payments.

Used at over 165,000 locations globally, Lightspeed caters to growing businesses looking for speed, customisation, and multi-store control.

Who It’s For

Multi-location retail stores

Growing hospitality brands

Independent boutiques aiming to scale

Omnichannel businesses (online + offline)

High-inventory retail operations

Restaurant chains using iPad-based POS

Core Value Proposition

“The commerce platform built for scale.”

Lightspeed helps growing businesses streamline operations, personalise customer experiences, and gain real-time insights from a single system.

Built-in payments and POS

Customisable roles and workflows

Advanced inventory and eCommerce integrations

Forecasting, landed costs, and API access

Real-time analytics and reporting dashboards

24/7 support with white-glove onboarding

Lightspeed Pricing Snapshot (Retail Plans – Monthly, USD)

Plan | Price/month (USD) | Best For |

Basic | $109/mo | Independent retailers with essential POS and inventory needs |

Core | $179/mo | Retailers seeking advanced tools to manage and grow operations |

Plus | $339/mo | Established multi-location retail chains with custom reporting needs |

Note: Pricing may vary by region and industry. Hardware sold separately.

Lightspeed Pros and Cons

Here are the top 5 Pros and Cons table for Lightspeed UK, based on their recent reviews:

✅ Pros | ❌ Cons |

Excellent POS system with strong reporting and stock management | Aggressive payment integration upsells (e.g., forced card payments) |

Fast payouts (next working day) that improve business cash flow | Poor experience with contract cancellations or refund disputes |

Smooth onboarding process praised by many reviewers | Onboarding support occasionally unresponsive or inconsistent |

Friendly and knowledgeable account managers (Theo, Simmone often praised) | Payment terminals reported to fail during high-pressure hours (e.g., weekends) |

Good support during setup and training | Pricing concerns, unexpected charges, and poor follow-up support |

What Makes Lightspeed Different?

All-in-one solution for POS, payments, inventory, and eCommerce

Flexible plans for businesses ready to scale from 1 to 100+ locations

Capital lending with pay-as-you-sell repayments

Custom roles and APIs for enterprise-grade control

Global reach but local UK support + onboarding team

Clover UK – POS for Multi-Branch Shops

What is Clover?

Clover is a full-service point-of-sale (POS) system designed for small to medium businesses with multi-location needs.

Owned by Fiserv, Clover combines payment processing, staff management, inventory control, and customer engagement tools into sleek, cloud-based hardware solutions like Clover Flex, Mini, and Station Duo.

Who It’s For

Multi-branch retail stores

Pubs, cafés, and restaurants

Service businesses needing mobile or countertop setups

Growing businesses looking for scalability

Businesses needing a single provider for hardware + merchant services

Core Value Proposition

“All-in-one POS that grows with your business.”

Take payments anywhere: online, in-person, mobile, or over the phone

Manage staff rotas, distribute tips, and track performance

Launch loyalty campaigns, discounts, and gift cards

Real-time inventory and sales insights across locations

Built-in business funding (up to £500,000) with repayments from card sales

Clover Pricing Snapshot

Promo Offer: 1.49% transaction fee + monthly service fee from £1

Hardware Included: Clover Mini, Flex, or Station (based on plan)

Contracts: Varies – typically bundled with Fiserv merchant accounts

Clover UK Pros and Cons

Pros | Cons |

Easy to set up and intuitive to use | Customer support can be inconsistent |

Sleek, modern hardware with mobile options | Pricing and fees are not always clearly communicated |

Works well for multi-location and retail businesses | Some users report slow response times during technical issues |

Built-in inventory and staff management tools | Limited customisation on lower-tier devices |

Real-time reporting with remote access via dashboard | Occasional glitches after software updates |

What Makes Clover Different?

Clover goes beyond payments, it’s a full business management system.

All-in-one POS with hardware, payments, and tools from Fiserv

Mobile and countertop options (Flex, Mini, Duo)

Cloud-based with real-time reporting

Built-in tools for staff, stock, loyalty, and sales

Works across locations and online/offline channels

Ideal for growing retail, service, or hospitality businesses.

Final Verdict: Which POS Is Right for You?

Use Case | Best POS Tool | Why It’s the Best Fit |

Small Shops or Food Stalls | Tapp | No hardware needed, fully mobile, low cost, perfect for small counters or solo operators |

Multi-Branch Retail Stores | Clover UK | Central dashboard, real-time reporting, inventory + staff control, good for scaling |

Mobile Sellers / Pop-up Businesses | Zettle by PayPal | Compact setup, easy to use, accepts all payments, fast onboarding |

Restaurants & Cafés | Square UK | Includes table management, online ordering, CRM & loyalty tools, all-in-one suite |

Appointment-Based Services (Salons, etc.) | Square UK | Built-in bookings, marketing tools, and customer profiles |

Fast Transactions / Busy Counters | Clover Duo | Dual-screen, fast checkouts, contactless-friendly |

Low-Budget Startups / First-Time Sellers | Tapp | Zero upfront hardware cost, accepts tap payments, simple setup from phone |

Inventory-Heavy Retail Businesses | Clover UK | Strong inventory tracking, sales insights, customisation options |

Businesses Needing Staff Payroll/Tip Tools | Clover UK | Integrated payroll, tip distribution, and rota management |

UK-based businesses looking for lowest processing fee | Zettle | Low flat-rate transaction fees with no monthly cost |

Final Thoughts

Choosing the right POS system isn’t just about features — it’s about fit.

If you’re running a café, salon, retail chain, or just starting out with a pop-up cart, the best tool is the one that works for your specific setup, not the flashiest.

Clover gives you deep control if you're scaling across branches.

Square brings a full suite if you're running bookings or restaurants.

Zettle keeps it simple for quick sales and small counters.

SumUp is decent if you're just looking to accept cards and keep costs low.

But if you want to skip the hardware, start instantly, and keep everything in your phone- Tapp is built for you.

Start Selling with Tapp - No Hardware Needed

Whether you're at a weekend market or managing multiple staff, Tapp lets you:

Accept tap-to-pay from any modern phone

Send digital receipts and track sales in real time

Keep costs low without bulky machines

👉 Get started with Tapp now and turn your phone into your point-of-sale.

Want a smarter POS?

Book a call and we will help you figure out, if Tapp is the right fit for your shop!