Reading time:

5 Best Square Alternatives & Competitors for Hardware-Free Payments

Discover 5 best Square alternatives in the UK for hardware-free payments. Compare features, fees & tools to get paid via links, QR codes & invoices.

Want to Get Paid Without a Card Reader?

We don’t all need a bulky POS machine to run our business.

Whether you run a food stall, cut hair, offer local services, or have just started a side hustle, we just want one thing:

✅ A simple way to accept payments.

Square is the go-to for many.

It works well, but it often means buying hardware, signing contracts, or paying fees we didn’t expect.

In the UK, there are easier options. Tools that let us take payments by:

Payment link

QR code

Invoice

We tried 5 tools that are:

Budget Friendly

Offers low processing fee

Easy to accept payment

No contract or reader required

In this guide, we’ll cover:

✅ The 5 best Square alternatives in the UK

✅ Which POS is best for you

✅ Features, pricing, pros & tradeoffs

✅ How to pick based on how we run our business

Let’s help ourselves get paid, no hardware, no hassle.

TL;DR

Common Concerns Users Have With Square

Square is one of the most popular payment tools for small businesses, and for good reason.

It's easy to set up, comes with decent hardware, and works well for many brick-and-mortar setups.

But when it comes to flexibility, ongoing costs, and scaling without hardware, many users start to feel limited.

Here are some of the most common concerns we’ve seen from UK-based sellers and service providers using Square:

❌ Delayed Payouts

Some users mentioned not receiving their funds for several days.

For businesses that rely on next-day deposits, this can hurt cash flow.

❌ Real Security Concerns

Multiple users reported fraud after using Square; charges appeared within minutes.

Even if it's not Square’s fault directly, it raises serious concerns.

❌ Weak Customer Support

Support is a common complaint. One user rated it “0” out of 10.

When payments fail or issues arise, help is often hard to reach.

❌ Higher Costs for Larger Transactions

While Square's flat fees seem simple, some larger businesses say they got better rates from traditional processors like Wells Fargo.

❌ Poor Fit for Service Businesses

Invoicing and billing features aren’t always smooth.

Delays in receipts and confusion around payment sources caused frustration for service providers.

What Should You Look for in a Hardware-Free Payment Tool?

When we first looked for Square alternatives, we didn’t want to deal with card readers, dongles, or extra devices. Maybe you feel the same.

If you want something simple that just works, here are the questions we asked, and you should too:

❓Can I accept payments using just my phone or browser?

You shouldn’t need any special hardware.

A good tool should let you accept payments on the go, right from your mobile or laptop.

If you move around a lot, sell at pop-ups, or work remotely, this is a must-have.

❓Does it support payment links or QR codes?

Personally, we love tools that let us send a payment link or show a QR code.

Your customer clicks, pays, done. No awkward card swiping. This works great for:

Sending payment requests over WhatsApp or email

Accepting money on Instagram or Facebook

In-person sales without machines

❓Can I send invoices directly from the app or dashboard?

If you’re like us and offer services, you’ll probably need to send invoices.

Look for tools that let you create and send them without using another platform.

It saves time, keeps things tidy, and helps you get paid faster.

❓Is the payment processor reliable and secure?

You want your money to land safely in your account, right? we always check which gateway the tool uses, PayPal, Stripe, or others that we trust.

If it’s a name you’ve never heard of, dig a little deeper.

❓Is the tool available in my country and currency?

We always make sure the platform supports my region.

If you’re in the UK, US, or EU, pick something that accepts local payments and complies with local rules.

❓Are the fees clear, and is it easy to set up?

Nobody likes surprise charges. We look for tools that show their fees upfront and don’t make setup a headache.

If you can sign up and start accepting payments in 5–10 minutes, that’s a win.

5 Best Square Alternatives & Competitors for Hardware-Free Payments

We looked into tools that work well for mobile sellers, freelancers, and small businesses, and found five good alternatives to Square.

Each tool listed here lets you get paid using just your phone or laptop.

No terminals, no machines.

Just links, QR codes, and fast setup.

Comparison Table: Square vs These 5 Hardware-Free Tools

Tool | Hardware Needed? | Payment Links | QR Payments | Best For | Region |

Usetapp.io | ❌ No | ✅ Yes | ✅ Yes | From market traders, food trucks, pop-ups, beauty professionals, to service providers and more | UK |

Zettle | ❌ Optional | ✅ Yes | ✅ Yes | PayPal users, market sellers | UK, US, EU |

SumUp | ❌ Optional | ✅ Yes | ✅ Yes | Mobile traders, small vendors | UK, EU |

Stripe Payment Links | ❌ No | ✅ Yes | ✅ Yes (via QR code) | Online-first & service businesses | Global |

Revolut Business | ❌ No | ✅ Yes | ✅ Yes | UK freelancers & digital services | UK |

Let's break them down in detail.

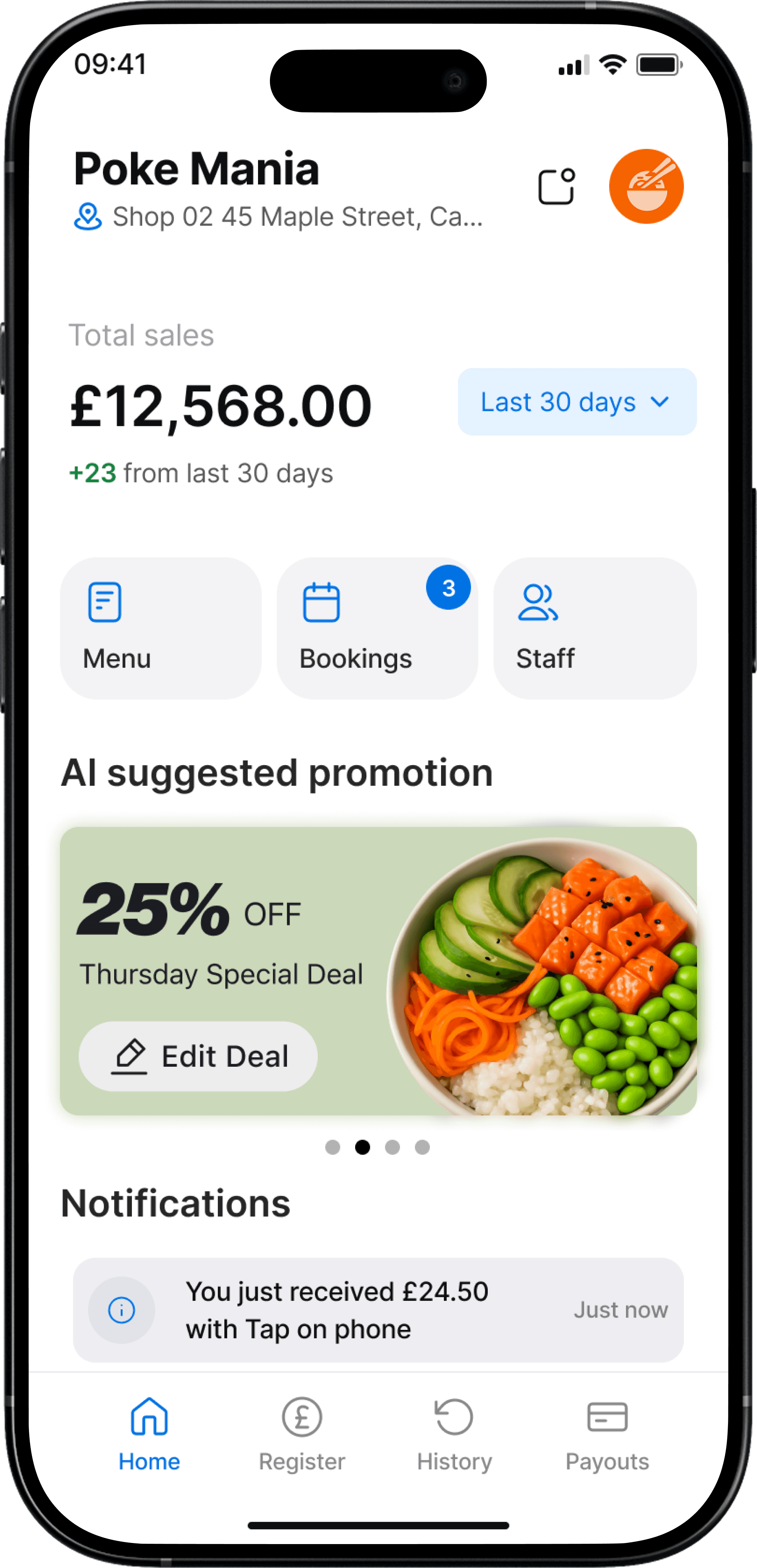

1. Usetapp.io (Top Pick for UK Sellers)

Usetapp.io is a UK-based Soft POS payment platform that lets you accept payments without using any hardware.

You can send payment links, share QR codes, or create invoices, all from your phone or laptop.

It’s one of the most practical Square alternatives for hardware-free payments in the UK.

Key Features

No hardware needed at all, just use your browser or phone

Send payment links directly through email, text, or WhatsApp

QR code support for quick in-person transactions

Invoice creation is built right in (great for service businesses)

Payment tracking via a clean, easy dashboard

Works on any device without installing anything extra

Why Usetapp.io is better than Square

Feature | Square | Usetapp.io |

Hardware Needed | ❌ Yes – requires card reader | ✅ No hardware needed |

Payment Links | ✅ Available via app | ✅ Instant link sharing |

QR Code Support | ✅ App-based QR codes | ✅ Built-in, quick QR codes |

Invoices | ✅ Available | ✅ Simple, built-in invoicing |

Device Support | ❌ Needs app or card reader | ✅ Works on any browser |

Best For | ❌ US-focused retail & restaurants | ✅ UK freelancers & mobile sellers |

Pricing | ❌ Hardware + transaction fees | ✅ No hardware, pay-per-transaction only |

Usetapp.io Pricing

Usetapp.io uses a pay-as-you-go model. That means:

No setup costs

Just a small fee per transaction

This is great if you’re starting or don’t sell daily.

You only pay when you earn.

Plan | Monthly Fee | Hardware Included | Features | Per-Transaction Fee |

Free | £0 | ❌ None | - Unlimited transactions - Business dashboard access - No setup cost or hidden fees | 1.49% per transaction (You keep £98.51 on £100) |

Pro | £29 | ✅ Offline dongle | - All Free features - AI sales prediction - Advanced analytics | 0.99% per transaction (You keep £99.01 on £100) |

Best For

Small businesses, freelancers, and mobile sellers in the UK who need a fast, easy way to get paid, without using card readers or POS terminals.

Where It Might Not Work

If you run a large retail store, need POS hardware, or sell outside the UK, Usetapp might not fit.

It’s designed for small UK sellers who prefer simplicity over advanced POS systems.

Final Verdict

If you're based in the UK and want a simple way to get paid without any hardware, we’d recommend trying Usetapp.io.

It’s quick to set up, runs on any browser, and does everything you need without the extra hassle.

But if you already use PayPal or run a physical market stall, you might prefer something more familiar, like Zettle.

2. Zettle by PayPal (Great for PayPal Users and Market Sellers)

Zettle is a mobile payment solution by PayPal that lets you accept payments in multiple ways, with or without hardware.

You can send payment links, use PayPal QR codes, or take contactless payments if you choose to add a card reader later.

We found it especially useful for its seamless PayPal integration and ease of use.

It's a great Square alternative if you already use PayPal.

Key Features

Optional hardware works even without the reader

Payment links through the Zettle or PayPal app

QR code payments via PayPal for quick mobile checkouts

Real-time payment updates through your PayPal Business account

Mobile app to manage inventory and sales

Funds land straight into your PayPal wallet

Why Zettle is Better Than Square

Feature | Square | Zettle by PayPal |

Hardware Needed | ❌ Yes, requires a card reader | ✅ Optional, works with or without hardware |

Payment Links | ✅ Available via app | ✅ Available through PayPal/Zettle app |

QR Code Support | ✅ App-based QR codes | ✅ Built-in PayPal QR support |

Invoices | ✅ Available | ✅ Managed through PayPal Business |

Device Support | ❌ Needs an app or a reader | ✅ Works on any phone with PayPal/Zettle |

Best For | ❌ US-focused retail | ✅ UK market sellers, PayPal users |

Pricing | ❌ Hardware + transaction fees | ✅ Free app, pay only per transaction |

Zettle Pricing

Zettle keeps it straightforward:

No monthly fees

Pay per transaction (around 1.75 percent in the UK)

An optional card reader if you ever need it

Payment Type | Transaction Fee | Notes |

Card Transactions | 1.75% per transaction | Applies to all major cards and mobile wallets, including Amex |

PayPal QR Codes | 1.75% per transaction | Available only to sellers who signed up before May 8, 2023 |

PayPal Invoices | 2.5% per transaction | Sent via PayPal Business |

Payment Links | 2.5% per transaction | Temporarily unavailable to new sellers during product updates |

For us, the fact that it plugs straight into my PayPal account made setup much faster; we didn’t need to create or connect anything extra.

Best For

Market sellers, event vendors, and freelancers who already use PayPal and want the flexibility to accept payments with or without hardware.

Where It Might Not Work

Zettle leans toward sellers already in the PayPal ecosystem.

If you're looking for pure hardware-free tools or want to avoid creating a PayPal account, this might feel like extra work.

Final Verdict

If you're already using PayPal, we’d suggest giving Zettle a try.

It’s flexible, easy to set up, and works great even without hardware, perfect for pop-ups, markets, or anyone on the move.

If you're looking for a flexible tool that also supports in-person and remote payments without locking you into a monthly plan, SumUp is worth checking out.

3. SumUp (Best for Mobile Traders and Solo Sellers in the UK & EU)

SumUp is a payment platform designed for small businesses that need flexibility on the go.

It lets you send payment links, generate QR codes, and issue invoices, all from your phone or browser.

Hardware is optional, which makes it a strong Square alternative for sellers who want low-cost, mobile-first payments.

We like how simple it is to get started with SumUp, especially for side hustles or casual selling where every pound counts.

Key Features

No hardware required, fully functional via phone or web

Payment links for remote or social media sales

QR codes for in-person transactions

Invoices and digital receipts are built in

Flat transaction fees with no contracts

Mobile app with sales tracking and reports

Why SumUp is Better Than Square

Feature | Square | SumUp |

Hardware Needed | ❌ Yes, requires a card reader | ✅ Optional, works fully without it |

Payment Links | ✅ Available via app | ✅ Quick links via mobile/web |

QR Code Support | ✅ App-based QR codes | ✅ Built-in, easy to scan |

Invoices | ✅ Available | ✅ Built-in invoicing with receipts |

Device Support | ❌ Needs an app or a reader | ✅ Works on any smartphone or browser |

Best For | ❌ US-focused retail | ✅ Mobile traders, casual sellers (UK/EU) |

Pricing | ❌ Hardware + transaction fees | ✅ No contract, flat transaction fees |

SumUp Pricing

SumUp charges a per-transaction fee based on how the payment is collected.

There are no setup fees, no monthly costs, and no contracts; you only pay when you make a sale.

Payment Method | Transaction Fee | When It Applies |

In-Person Payments | 2.6% + 10¢ | For card swipes, taps, or chip inserts via the SumUp card reader or POS system |

Online & Manual Entry | 3.5% + 15¢ | For online checkout, payment links, or when entering card info manually |

SumUp Invoicing | 2.9% + 15¢ | When a customer pays an invoice via SumUp’s online payment link |

It’s a great fit if you want to avoid long-term contracts or heavy upfront costs.

Best For

Mobile traders, food stalls, and solo sellers in the UK and EU who want a reliable, low-friction way to accept payments without committing to hardware upfront.

Where It Might Not Work

SumUp works well for in-person sellers, but online payment features are limited.

If your business is fully remote or service-based, you may find better options for links or invoicing.

Final Verdict

SumUp offers a straightforward way to accept payments on the move.

It’s easy to set up, doesn’t rely on hardware, and suits flexible selling environments where cost and simplicity matter.

On the other hand, if your business is entirely online and you just want to send payment links without dealing with any hardware at all, Stripe could be a better fit.

4. Stripe Payment Links (Best for Online-First and Service-Based Sellers)

Stripe Payment Links is a global payment solution that supports sellers in the UK, EU, and beyond.

It enables businesses to accept online payments through shareable checkout links, without needing a website, app, or hardware. Ideal for service providers and digital sellers working remotely.

We found Stripe useful for handling quick payments without needing to build a full checkout system.

Key Features

No app or reader required, just create and send a link

Accepts credit/debit cards, wallets, and bank transfers

Mobile-friendly checkout pages

Add your logo, product name, and pricing to each link

Real-time payment tracking via the Stripe dashboard

Supports one-time and recurring payments

Why Stripe Payment Links is Better Than Square

Feature | Square | Stripe Payment Links |

Hardware Needed | ❌ Yes – requires card reader | ✅ No hardware needed |

Payment Links | ✅ Available via app | ✅ Direct link, no app or device needed |

QR Code Support | ✅ App-based QR codes | ❌ Not built-in |

Invoices | ✅ Available | ✅ Invoice support via dashboard |

Device Support | ❌ Needs an app or a reader | ✅ Works on any browser or device |

Best For | ❌ US-focused retail | ✅ Online sellers, freelancers, service-based businesses |

Pricing | ❌ Hardware + transaction fees | ✅ Transparent per-transaction pricing |

Stripe Pricing

Stripe charges per transaction, with rates based on card type and location.

There are no setup or monthly fees.

✅ Card Transaction Fees

Type | Fee | Notes |

Domestic Cards (India) | 2% | Mastercard/Visa (0.4% MDR for debit, capped at ₹200) |

International Cards | 3% + 2% (if currency conversion) | Mastercard/Visa |

Amex (International) | 3.5% + 2% (if conversion needed) | |

Others (USD/foreign) | 4.3% + 2% (if conversion needed) |

✅ Optional Add-ons

Feature | Fee |

Invoicing (Starter) | 0.4% per paid invoice |

Subscription Billing | 0.7% of billed volume |

Radar (Fraud Protection) | ₹4–₹6 per screened txn |

Dispute Tools (Visa/MC) | ₹1,000–₹2,000 per case |

Best For

Freelancers, consultants, and online sellers who want to take payments without using hardware, and need a simple link-based solution that works globally.

Where It Might Not Work

Stripe is great for online payments, but setup can feel technical. If you're just starting out or prefer something plug-and-play, it might be overkill for now.

Final Verdict

Stripe Payment Links offer a clean way to accept payments online without any physical setup.

It’s built for digital-first businesses that value speed, flexibility, and a global reach.

And if you're managing a team or need extra control over spending and transactions, Revault brings hardware-free payments with built-in finance tools for UK businesses.

5. Revolut Business (Great for Freelancers and Digital Sellers in the UK)

Revolut Business is a UK-based payment platform designed for modern businesses, freelancers, and remote-first teams.

It allows you to accept payments online using payment links, QR codes, and invoices, all without needing a card reader or POS hardware.

While comparing hardware-free tools in the UK, we found Revolut to be especially useful for digital services and businesses that work across borders.

Key Features

No hardware required, fully online and mobile-accessible

Create and share payment links instantly

Accept payments via QR codes or custom checkout pages

Built-in invoicing with branded templates

Multi-currency accounts and real-time FX rates

Instant payouts into your Revolut Business account

Connects easily with accounting platforms (like Xero, QuickBooks)

Why Revolut Business is Better Than Square

Feature | Square | Revolut Business |

Hardware Needed | ❌ Yes, requires a card reader | ✅ No hardware needed |

Payment Links | ✅ Available via app | ✅ Instant link generation in-app or desktop |

QR Code Support | ✅ App-based QR codes | ✅ Built-in QR code support |

Invoices | ✅ Available | ✅ Customisable invoicing built in |

Device Support | ❌ Needs an app or a reader | ✅ Works on any browser or mobile device |

Best For | ❌ US-focused retail | ✅ UK freelancers, agencies, service providers |

Pricing | ❌ Hardware + transaction fees | ✅ Clear pricing, no reader required |

Revolut Business Pricing

Revolut Business offers multiple plans based on business size and volume.

All plans include hardware-free payment features:

Plan | Monthly Fee | Per-Transaction Fee | Notes |

Free | £0 | From 1.3% | Includes payment links, invoicing, etc. |

Grow | £25/month | Lower rates from 0.8% | Higher limits, extra support features |

Scale | £100/month | Custom pricing | For high-volume or scaling businesses |

Accepts Visa, Mastercard, Apple Pay, Google Pay

Instant payouts to a Revolut account

No additional hardware fees

Best For

UK freelancers, agencies, and online service providers who need simple, flexible payments without investing in hardware.

Where It Might Not Work

Revolut is more of a business banking solution.

If you only need a lightweight payment tool without managing accounts, fees, or cards, it could feel like too much.

Final Verdict

Revolut Business offers a modern, no-hardware payment solution built for today’s flexible work environment.

With fast setup, multi-currency support, and seamless payment options, it’s a strong fit for digital-first businesses in the UK.

Why You Should Go For Hardware-Free Payment

If you're a small business owner, freelancer, or mobile seller in the UK, switching to hardware-free payments isn’t just about convenience; it’s about working smarter, faster, and more affordably.

Here’s why it makes sense:

✅ No Upfront Hardware Costs

You don’t need to buy a card reader or terminal to start taking payments.

Most tools only charge a small fee per transaction, so you can start selling with just your phone or laptop.

✅ Sell Anytime, Anywhere

Whether you’re at a market stall, visiting a client, or working from home, hardware-free tools let you accept payments on the go using links, QR codes, or invoices. No wires. No setup.

✅ Faster Setup, Less Hassle

Getting started with a reader-free platform takes minutes.

There’s no complicated hardware to install or maintain, just log in, share a link, and get paid.

✅ Perfect for Flexible Workflows

If you’re not tied to a physical location, you shouldn’t be tied to physical hardware.

Hardware-free payment tools adapt to how you work, whether it’s online, mobile, or in-person.

✅ Ideal for Modern UK Sellers

Many UK sellers now operate online-first or as pop-ups and service providers.

Hardware-free options are built for these use cases, are simple, portable, and are designed for modern business models.

In short, hardware-free payment tools help you cut costs, move faster, and sell wherever your customers are, without needing anything but your device and internet.

How to Choose the Right Square Alternative (Based on Your Use Case)

Use Case | Best Tool |

Selling locally in the UK without hardware | Usetapp.io |

Using PayPal and selling at markets or pop-up events | Zettle by PayPal |

Running a small stall or mobile service, want flexibility and optional scale | SumUp |

Offering services online or sending remote payment links | Stripe Payment Links |

Freelancing or managing digital clients across currencies | Revolut Business |

Conclusion

If you're running a business in the UK and want to accept payments without card readers or bulky POS systems, hardware-free Square alternatives give you all the flexibility without the upfront cost.

Whether you're a freelancer, pop-up vendor, or a growing online service, there's a tool built for how you work.

Need fast QR and link-based payments? Usetapp.io is built for it.

Selling at events and already using PayPal? Zettle fits in naturally.

Want the option to grow into a full POS later? SumUp gives you that flexibility.

Selling online and need fast payment links? Stripe keeps it simple.

Managing clients across borders? Revolut Business handles it all in one place.

The right tool depends on how you work, but the goal is the same: get paid easily, from anywhere, without hardware.

Looking for a simple way to get paid without hardware? Try Usetapp.io, built for UK businesses like yours.

FAQs

❓ What is the best Square alternative without hardware?

If you're in the UK and want a truly hardware-free solution, Usetapp.io is a great pick. It works entirely from your browser, no terminals, no downloads, no setup headaches.

❓ Can I accept payments on my phone without a card reader?

Yes. Tools like Usetapp, Zettle, Stripe Payment Links, and SumUp let you send payment links, QR codes, or invoices, all from your phone or laptop. No card reader required.

❓ Is PayPal Zettle better than Square for mobile payments?

Zettle gives you more flexibility if you're already using PayPal or want optional hardware later. It’s often preferred by small UK sellers and market vendors who want to keep things simple.

❓ Are payment links secure for customers?

Yes. Usetapp, Zettle, Stripe Payment Links, and SumUp use trusted payment gateways and encryption protocols. Customers are redirected to secure checkout pages, just like they would be on any e-commerce store.

❓ Does Usetapp work in the UK?

Absolutely. Usetapp.io is built specifically for UK freelancers, small businesses, and mobile sellers. It supports local payments, GBP currency, and UK-based regulations.

Want a smarter POS?

Book a call and we will help you figure out, if Tapp is the right fit for your shop!