Reading time:

5 Best Zettle (By PayPal) Alternatives For Your Business

Explore the best Zettle alternatives in the UK for lower fees, faster payouts, and flexible SoftPOS options. Compare Tapp, Dojo, SumUp, Paynt & Square.

Zettle has served small businesses well over the years, but more users are now running into problems.

High transaction fees, limited control over payment methods, and support that feels harder to reach have led many to start exploring other options.

Here’s a review by Tim about poor customer service:

Whether you are just starting out or looking to simplify your setup, there are alternatives that offer lower fees, mobile-first design, and more control over how you get paid.

In this guide, we break down the best Zettle alternatives in the UK so you can find a payment solution that fits your business and works the way you need it to.

Best Zettle Alternative Overall UK

Here’s a quick overview of the best options, which we explore in more detail later in this guide:

Best overall SoftPOS provider in the UK: Tapp

Best for iPhone-only setups: Dojo

Best for budget-friendly plans: SumUp

Best for custom integrations and tipping: Paynt

Best for online and in-person selling: Square

How We Evaluated Zettle Competitors

In order to determine the best Zettle alternatives, we considered the following factors:

Overall reliability and real-world performance of each SoftPOS app

Device compatibility, whether they support both Android and iOS.

Setup time.

Transaction fees per payment.

Device compatibility.

Offline payment capability.

AI tools

Payout speed.

The customer support.

Are the tools PCI compliant?

Other key features - tipping, receipts, self-checkout, and integrations.

These were the traits that made the best SoftPOS providers stand out, and the areas where Zettle often falls short.

Common Issues Reported with Zettle

While Zettle remains a widely used solution for small businesses, recent customer feedback reveals several recurring issues.

These concerns can affect both day-to-day operations and long-term reliability.

Customer Support is Unreliable

Users report slow replies, unresolved tickets, and no clear escalation process when issues arise.

Here’s what Stuart has to say in his review:

Accounts Get Frozen Without Warning

Several merchants had accounts suspended or payouts withheld, often without a clear reason or timeline for resolution

Payout Delays and Missing Funds

Payments have gone missing, been redirected to the wrong bank accounts, or delayed for weeks with little support.

Devices Fail Post-Warranty

Card readers stop working just outside the warranty window. Support tells users to buy a new one, even if barely used.

Too Complicated for Simple Use

The app setup and PayPal link are overly complex for casual sellers or pop-ups wanting quick tap-to-pay solutions.

Software and Device Bugs

Terminals freeze, apps crash, and devices stop responding. Updates can brick readers with no easy fix.

The Best Zettle Alternatives in 2025

Finding the best Zettle alternative really depends on what matters most to your business.

We’ve reviewed the top options so you don’t have to scroll through sales pages or sit through demos.

Zettle Alternatives Quick Comparison Table:

Feature | Tapp | Dojo | SumUp | Paynt | Square | Zettle by PayPal |

Hardware | No hardware needed | Card machines or iPhone only | Phone only or add card reader | SoftPOS or card machine options | Tap to Pay or card readers | Tap to Pay supported, mainly card readers |

Setup | App-based with quick onboarding | In-person help or app | Simple app setup | Digital onboarding with customisation | Online signup or app | App-based, delays in verification reported |

Transaction Fees | 1.49% (Free) or 0.99% (Pro £29/month) | Custom pricing, starts at 1% | From 0.99% with Payments Plus | Custom per business | 2.6% + 15p per transaction | 1.75% flat |

Offline Payments | Yes (Pro dongle required) | Not available | Not available | Not available | Yes (up to 24 hours) | Not available |

AI Features | Yes – smart menus and sales forecasts | No | No | No | Basic automation (e.g. stock alerts) | None |

Online Checkout | Self-checkout and QR payments | Not available without card machine | Payment links, online store, QR codes | Links, subscriptions, virtual terminal | Store, links, invoices, subscriptions | Payment links and PayPal gift cards |

Payout Speed | To be confirmed | Next-day by default | Next-day from 7am | Next-day available | Next day or instant with fee | Instant to PayPal |

Support Quality | Yet to be reviewed | Mixed, aggressive sales tactics reported | Common complaints about access and delays | Mixed experiences despite 24/7 claim | Poor support, reports of account holds | Often criticised for limited support |

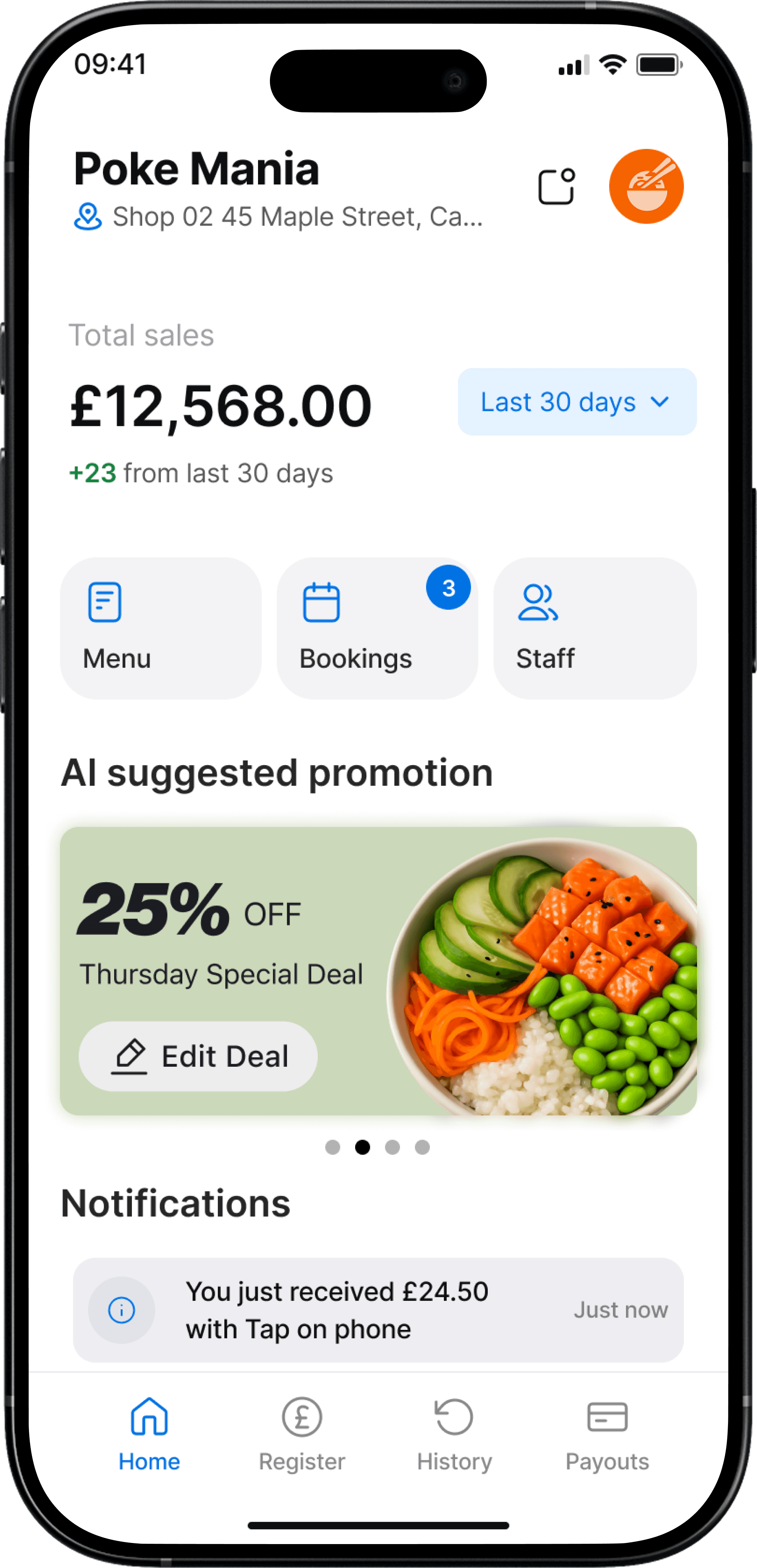

#1 Tapp (Best Zettle Alternative for Mobile and Flexible Selling)

Tapp is a SoftPOS app that lets you take contactless card payments directly on your smartphone. There is no need for a card reader or terminal.

Like Zettle, it offers tap-to-pay on phones, but Tapp is built entirely around this experience so you can start selling without buying extra hardware.

Tapp works with all major cards and wallets including Visa, Mastercard, Amex, Apple Pay, and Google Pay.

You also get features that Zettle does not offer such as smart menus, sales forecasting, self-checkout, and an eShop for online ordering.

If you need to take payments without internet access, the Pro plan includes a dongle that works offline.

Feature | Tapp | Zettle by PayPal |

Hardware | No hardware needed | Tap to Pay on phone supported but mainly uses card readers |

Setup | App-based with quick onboarding | Easy but delays in verification are often reported |

Transaction fees | 1.49 percent (Free) or 0.99 percent (Pro £29/month) | 1.75 percent flat |

Offline payments | Yes with free dongle on Pro | Not available without working reader and connection |

AI features | Yes including smart menus and sales forecasts | None |

Online checkout | Includes self-checkout and QR payment tools | Offers payment links and gift cards via PayPal |

Payout speed | To be confirmed | Funds reach PayPal within minutes |

Pros

No need for card readers or terminals

Lower transaction fees on the Pro plan

Smart features like AI-driven sales forecasts and digital menus

Self-checkout and online ordering included

Offline payment option with dongle

Cons

Offline dongle requires the Pro plan

Payout structure still to be announced

Tapp is a solid alternative to Zettle if you want to keep things simple and run everything from your phone.

It removes the need for hardware, offers lower fees, and gives you smarter tools to help you sell and manage more efficiently.

If your business is mobile or service-focused, Tapp is built with that in mind.

#2 Dojo (Best Zettle Alternative for Fast Payments and Card Machine Support)

Dojo is a UK-based payment provider offering both SoftPOS (Tap to Pay on iPhone) and a range of fast, reliable card machines.

It’s designed for businesses that want in-person payment flexibility, faster settlement, and integrations with existing EPOS systems.

Like Zettle, Dojo supports Tap to Pay on compatible smartphones, but its real focus is on high-speed terminals like the Dojo Go, which is claimed to be 58 percent faster than industry average.

You can also choose from other hardware options or go fully hardware-free with just your iPhone and the Dojo app.

Dojo offers smart reporting tools in its business app, along with next-day payouts as standard.

However, reviews highlight issues with aggressive sales tactics, long contract terms, and inconsistent customer support.

Feature | Dojo | Zettle by PayPal |

Hardware | Optional. Use card machines or iPhone only | Card reader or terminal usually required |

Setup | Setup with in-person help or app-based onboarding | Easy setup but users report delays in verification |

Transaction fees | Custom pricing. Flat rate starts at 1 percent | 1.75 percent flat |

Offline payments | Not available | Not available |

AI features | No AI tools | None |

Online checkout | Not available without physical card machine | Payment links and gift cards via PayPal |

Payout speed | Next-day by default | Instant to PayPal |

Pros

Fast payments with high-speed card machines

Tap to Pay on iPhone available

Next-day payouts included as standard

Works with over 400 EPOS providers

Simple PCI reporting in app

Cons

Card machine contracts can be restrictive

Complaints of delayed support and unresolved issues

Reports of aggressive cold calling and pushy sales tactics

No full SoftPOS option for Android

Online payments not available without physical hardware

Dojo is a practical alternative to Zettle if you want fast card machines and strong EPOS integration.

It suits busy retail or hospitality environments where speed and payout timing matter.

But if you want to avoid hardware or prefer more transparent pricing and softer onboarding, it may be worth considering other options like Tapp.

#3 SumUp (Best Zettle Alternative for Budget-Friendly Plans and Payment Flexibility)

SumUp is a well-known UK payment provider that offers a mix of card readers, SoftPOS (Tap to Pay), and affordable pricing plans.

Like Zettle, it supports contactless payments using just a phone, but SumUp also provides more flexible options for hardware and transaction fees depending on your turnover.

You can start with just the free app and accept payments with Tap to Pay on iPhone or Android.

Or you can add hardware like the SumUp Air or Solo card readers.

For growing businesses, SumUp offers paid plans like Payments Plus, which lowers transaction fees and includes access to extra tools like loyalty programmes, bookings, and advanced POS features.

However, customer reviews repeatedly highlight poor support, payout delays, and difficulties accessing accounts issues, that Zettle users also report.

Feature | SumUp | Zettle by PayPal |

Hardware | Optional. Use phone only or add a card reader | Mostly hardware-based with a Tap to Pay option |

Setup | Simple app setup with no paperwork | Easy setup, but delays in verification are common |

Transaction fees | From 0.99% with Payments Plus | 1.75% flat |

Offline payments | Not available | Not available |

AI features | No AI tools | None |

Online checkout | Payment links, online store, QR codes | Payment links and gift cards via PayPal |

Payout speed | Next-day payouts from 7am | Instant to PayPal |

Support quality | Widely reported issues with access and responsiveness | Also criticised for slow, limited support |

Pros

Tap to Pay on both iPhone and Android

Lower transaction fees with Payments Plus plan

Free business account with early-morning payouts

Flexible plans and hardware options

Built-in tools like payment links, loyalty, and booking system

Cons

Many users report delayed payouts and frozen funds

Customer service is slow and difficult to reach

No offline payment support

No AI tools or smart sales features

Card reader setup can feel clunky without POS system

SumUp is a practical Zettle alternative if you're looking for lower fees, Tap to Pay flexibility, and a quick start.

But if you value reliable customer support and consistent access to your funds, the ongoing complaints from users are worth serious consideration.

#4 Paynt (Best Zettle Alternative for Customisable POS and Global Acceptance)

Paynt is a full-scale payments provider that offers everything from SoftPOS and card machines to tipping, online checkouts, and full EPOS integrations.

Like Zettle, it supports contactless in-person payments, but Paynt puts a stronger focus on customisation, multi-channel selling, and business intelligence tools.

Paynt supports all major payment methods, including Visa, Mastercard, Amex, Apple Pay, and Google Pay.

It integrates with more than 50 leading EPOS platforms and allows custom branding of receipts, terminals, and even tipping interfaces.

It supports advanced transaction types like MOTO, pre-auth, and partial captures, and provides tools for managing refunds, sales limits, and permissions per staff member.

Businesses can also access .

However, support is where Paynt, like Zettle, receives criticism.

Although 24/7 assistance is advertised, users have raised concerns about lack of response or clarity during issue resolution.

Feature | Paynt | Zettle by PayPal |

Hardware | Optional. SoftPOS or card machine options available | Card readers and terminals usually required |

Setup | Digital onboarding. Full setup with customisation | App-based. Some report delays in account approval |

Transaction fees | Custom pricing per business | 1.75% flat |

Offline payments | No full offline support | Not available |

AI features | No AI tools | None |

Online checkout | Payment links, subscriptions, and virtual terminals | Payment links and gift cards via PayPal |

Payout speed | Next-day payouts available | Instant to PayPal |

Support quality | 24/7 available but mixed experiences reported | Support frequently criticised in user reviews |

Pros

SoftPOS option for contactless payments using your phone

Accepts all major payment methods

Works across multiple sectors including hospitality and retail

Custom branding on receipts, terminals, and apps

Supports advanced payment types like MOTO and pre-auth

Next-day settlements

Cons

Support quality can vary despite 24/7 claim

No built-in AI tools or smart forecasting

No offline payment capability

Requires some technical know-how for full customisation

Paynt is a strong Zettle alternative for businesses that want more control over their POS setup, need flexibility in how they accept payments, and operate across multiple channels or locations.

While the setup may be more advanced than Zettle, the features and customisation can better support complex business needs..

#5 Square (Best Zettle Alternative for Selling Online and In Store Together)

Square gives you everything you need to take payments in person, online, or over the phone.

Like Zettle, it lets you accept Tap to Pay directly on your iPhone or Android without any extra hardware.

But it also comes with extra tools like a website builder, email marketing, inventory tracking, and buy now pay later through Afterpay.

You can start with the free Square plan and use just your phone to take payments.

You can also upgrade to add card readers, a complete POS system, or even a full online shop using Square’s platform.

It supports features like offline payments for 24 hours, quick access to sales reports, and the option to transfer funds instantly to your bank.

But Square gets a lot of criticism for how it handles accounts.

Many UK users report having their funds suddenly held, accounts deactivated, or hardware updates getting in the way of sales.

Refunds can take over a week to reach customers and getting help from support often means waiting with no real resolution.

Feature | Square | Zettle by PayPal |

Hardware | Optional. Use Tap to Pay or choose from readers and terminals | Tap to Pay and card reader required |

Setup | Sign up online or in the app and start taking payments | App-based with some delays in verification reported |

Transaction fees | Starts at 2.6 percent plus 15p per transaction | Flat 1.75 percent |

Offline payments | Supported for up to 24 hours | Not supported |

Online checkout | Includes online store, links, invoices, subscriptions | Payment links and gift cards via PayPal |

AI Features | Basic automation like low-stock alerts and sales trends | No AI tools |

Payout speed | Free next business day or instantly for a small fee | Instant to PayPal account |

Support quality | Many users report slow, unhelpful support and poor resolution | Regularly criticised for limited support |

Pros

Accept Tap to Pay on both Android and iPhone

Free online store and virtual terminal included

Invoices, subscriptions, and gift cards are supported

Offline mode keeps payments going without Wi-Fi

All tools work from one account with no contract

Cons

Reports of funds being held without warning

Customer support rated poorly across reviews

Refunds can take up to two weeks for customers

Hardware often gets stuck on software updates at the wrong time

Not the most affordable for occasional users

Square is a feature-rich Zettle alternative if you want one system for both online and in-person sales.

But the way it handles accounts holds and support means it may not be the best fit for small businesses that rely on reliable cash flow and fast service.

Tapp is more relevant for small and medium businesses.

Conclusion

If you're looking for a Zettle alternative, there are plenty of solid options depending on how your business operates.

Square works well if you want everything in one platform, from an online store to loyalty tools.

But issues with support and account holds are something to be aware of.

Paynt gives you a lot of flexibility with tipping and terminal options, especially if you're in hospitality, though the setup can feel heavier and more complex.

But if you're after something simple, mobile-first, and ready to go in minutes, Tapp stands out.

You can take tap-to-pay payments on your phone with no card reader, the app handles all the security and compliance in the background, and you pay lower fees on the Pro plan.

It’s especially well-suited for people who work on the go or don’t want to deal with hardware or complex setups.

If that sounds like what you need, starting with Tapp could be the easiest next step.

Want a smarter POS?

Book a call and we will help you figure out, if Tapp is the right fit for your shop!